Designing a Hybrid Investing Product

Sector: Financial | Investments | Hybrid Investing My Role: Head of Wealth Design | Strategic Leadership | Hands-on Creative Lead

Design Challenge

Develop a best-in-class hybrid investment product that differentiates itself from other hybrid investment products while showing how the product fits into a new or existing investment portfolio.

Core Assumptions

What it is: CWB+: Hybrid advisory at a lower cost than full advisory, with human guidance + automated portfolio management.

Where it fits: Between Self-Directed / Robo (CWB) and Full Advisory. It’s the “level-up” path when needs exceed DIY or robo but don’t require full-service wealth management.

Who it serves: All segments (Blue, Priority, Gold, Private Client) as a value-efficient advisory on-ramp—especially those with growing complexity but price sensitivity.

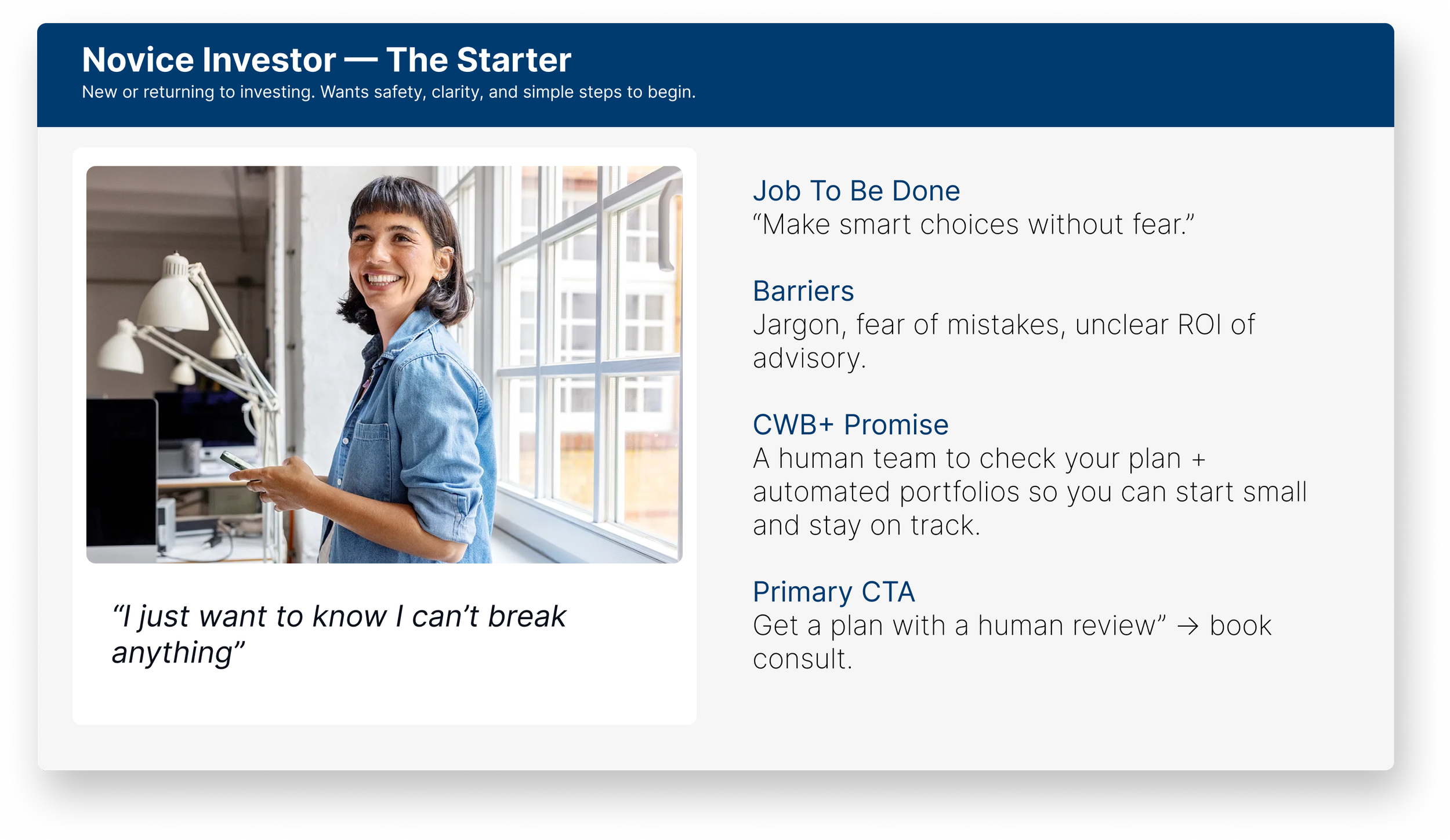

Audience Definition

We combined market, customer, competitive, and UX research with Citi’s cross-segment data to develop personas (Starter, Optimizer, Growth, Controller) reflecting goals, life moments, risk, and expertise. These personas anchored the end-to-end journey, guiding design decisions from discovery through advisory and shaping how we measured success.

*The personas are representative examples

Methodology

I created our agile approach emphasized short sprints and iteration, paired with a modified design thinking framework. This allowed us to design from insights while continuously exploring new opportunities.

Key elements of the process included:

Cross-disciplinary alignment sessions to define scope, objectives, and timing

Design embedded at the table to shape strategy, contribute ideas, and backlog future iterations

Forward momentum mindset—learning from research while keeping sight of the bigger picture

Ideation as a core driver, inspiring teams to deliver meaningful, impactful products

Establish a Clear Positioning

The challenge was positioning Citi Wealth Builder and Citi Wealth Builder Plus as part of one suite while highlighting their unique benefits. Research showed that presenting them side by side, as automated solutions with different levels of support,empowered customers to choose the option best suited to their goals.

Turning Complexity Into Clarity

For CWB+, the challenges were creating a seamless onboarding and investing experience for customers.

Key aspects of the challenge:

In-depth AO: A more detailed account opening process was needed to capture a complete view of each customer’s strategy.

Offline Planning Sessions: Requiring customers to speak with an advisor, essential for funding and strategy alignment, before resuming their online investing journey.

Growth: Added Roth and Traditional IRAs to support long-term investing, strengthening Citi’s offering and providing options to customers.

Building Personalized Portfolios

In setting up CWB+, customers selected key variables to match them with the right investment strategy. This personalization created clear value but required simplifying the backend flow with clear language and progressive steps.

Time Intensive – Introduced a progressive stepper with save & resume and plain-language sidebars.

Complex Language – Added plain-language summaries, glossary popovers, and contextual guidance.

Path Confusion – Reinforced advisory support and planning sessions to guide choices.

Drop-Off – Set expectations upfront, simplified steps, and clarified “what you get” with CWB+.

Aligning Account Type with a Plan

Selecting the right retirement account type is a critical step in aligning investing with customer goals. By guiding users through Roth, Traditional IRA, or brokerage options, the experience helped match account selection with individual needs, whether optimizing for tax advantages, long-term growth, or flexibility, ensuring customers felt confident their choices supported their financial future.

Profile Setup

Designing the customer profile required simplifying complex requirements at the end of a long account-opening process. Research informed streamlining, clearer language, and key UX improvements, reducing friction and building customer confidence.

Setting an Appointment

Scheduling a consultation is a critical activation step for CWB+ but added friction as customers often paused or missed the offline appointment. We tested nudges, reminders, and value framing to highlight its payoff while keeping the flow simple and low-effort.

Challenges

Momentum break

Unclear value of the meeting

Availability anxiety & choice overload

Cross-device drop-off

Accessibility & comfort

Solutions

Nudges/Banner Reminders

Stepper guide (Next Best Action)

One-click reschedule

Email/SMS/Push Notifications

Education/Content support

Onboarding and Funding

Onboarding and funding were crucial to product success. Clear tutorials, education, and personalized nudges gave customers confidence to start. Research showed early funding drove greater engagement and investment, while delays led to lower activity.

Projections and Holdings

Research showed CWB+ customers engaged less often but with clear intent, seeking visibility into allocations and potential changes. To address, we built a projection tool to model outcomes, spark advisor conversations, and educate customers on strategies like dollar-cost averaging.

Personalization in Key Moments

Our strategy focused on identifying key moments to engage customers, showing value while helping them optimize their portfolios. Features like the IRA Contribution Tracker and Annual Review Tracker became critical touchpoints, ensuring customers stayed on track with their goals and remained connected with their advisory team.

Learnings and Outcomes

Throughout the process from team conception to product delivery the resounding them was being able to adapt and lead through change. Citi is a large organization enabling many opportunities for customer reach and impact while having to understand the internal complexities of conflicting stakeholder objectives and constraints. Design acted as the connective tissue across business, product, and technology to illustrate and guide the strategy to produce such a large and complex solution.