Building an Investment Suite at Enterprise Scale

Sector: Financial | Investments | Employee Experience My Role: Head of Wealth Design | Strategic Leadership

Challenge

Develop a best-in-class investment solution suite for customers seeking self-directed investing or advisor-led guidance. The goal was to position Citi Personal Wealth Management as a trusted provider of strategies across customer personas and segments—while creating a design system that broke down barriers and was future-ready for new products and features.

Design Principles

Our design principles were grounded in real customer needs while keeping a forward-looking perspective. We made them simple, clear, and results-driven - ensuring focus on the customer and measurable business impact.

Leadership Challenges

When starting a large, complex design challenge, it was critical to establish a core structure and process to manage the workload with limited time and resources. With high internal visibility and expectations, we needed a clear, strategic path forward.

-

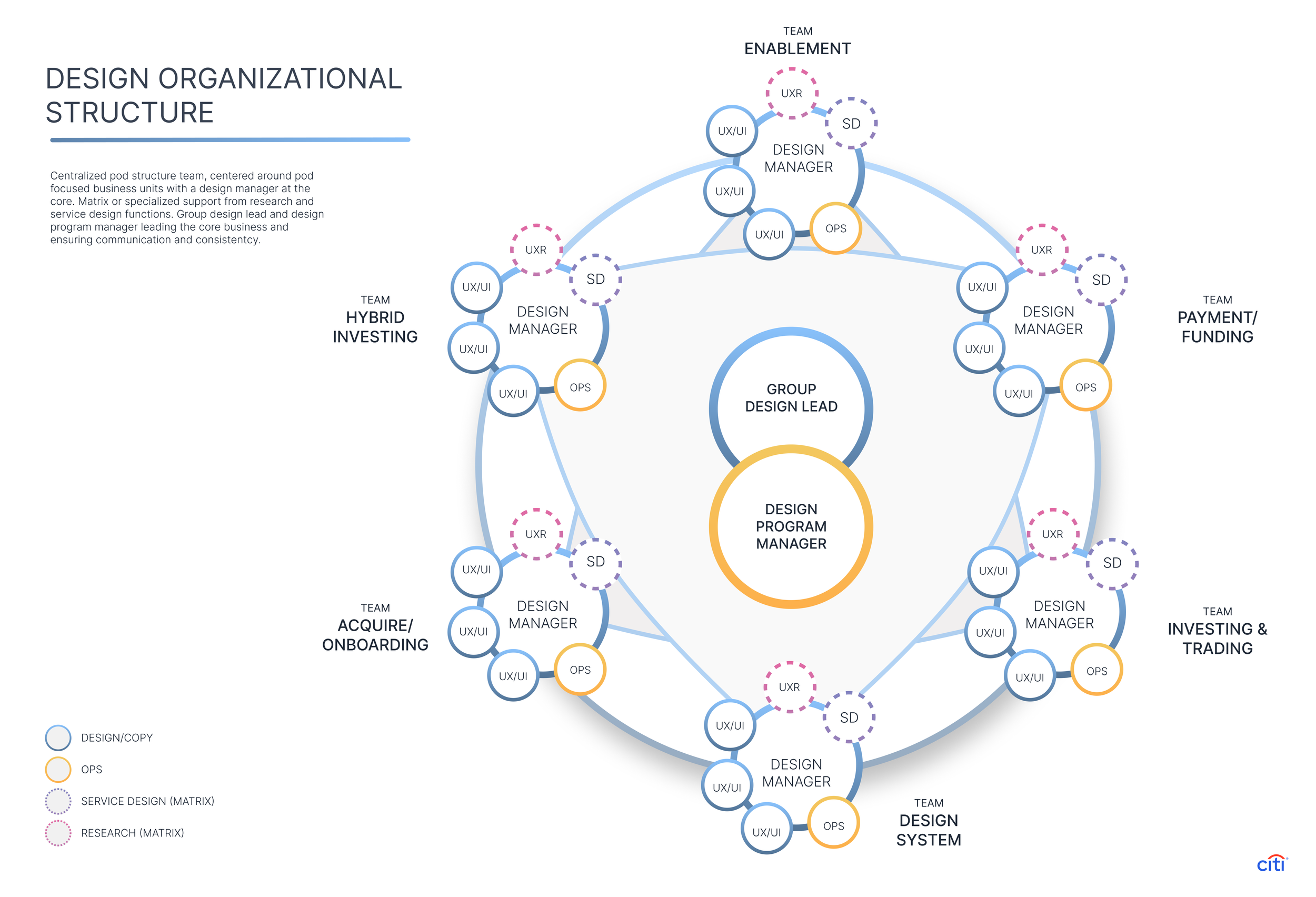

It was imperative the team had autonomy and ownership of the work. I organized a pod structure with clear lines of ownership and reporting. Each pod was self running and aligned to product owners and tech leads. This created a self running team with direction and a sense of responsibility and pride. My role was to ensure they had the tools, support, praise, and clear direction needed to have success.

-

I created a new way of working within Citi that was strategy and research based but was nimble at its core. The process was based in agile but adapted to the Citi release cycles to align to launches. The team was able to work on multiple products at a time while have core teams of enablement and acquisition run as unifying threads throughout.

-

Showing and illustrating how the product worked and how customers interacted, was key to the success both internally and externally. Design was integrated from the beginning, running service design and design strategy workshops to drive customer understanding and knowledge. Leading the vision and product development showed how design plays a important and key role in the product lifecycle.

-

From the start, my team and I designed the ideal vision for Citi Wealth creating videos, posters, workshops, persona boards, emails, etc, etc to show how an end-to-end experience could work across platforms and regions. Many of the concepts and ideas influenced the creation of the product roadmap.

Team Organization

Structuring a design team is about more than roles, it’s about creating the right balance of support, autonomy, and accountability. Clear frameworks and communication build trust and alignment, while giving designers the space to own their work and grow. This balance is what enables teams to deliver consistently, innovate confidently, and scale successfully.

Methodology

I created our agile approach emphasized short sprints and iteration, paired with a modified design thinking framework. This allowed us to design from insights while continuously exploring new opportunities.

Key elements of the process included:

Cross-disciplinary alignment sessions to define scope, objectives, and timing

Design embedded at the table to shape strategy, contribute ideas, and backlog future iterations

Forward momentum mindset—learning from research while keeping sight of the bigger picture

Ideation as a core driver, inspiring teams to deliver meaningful, impactful products

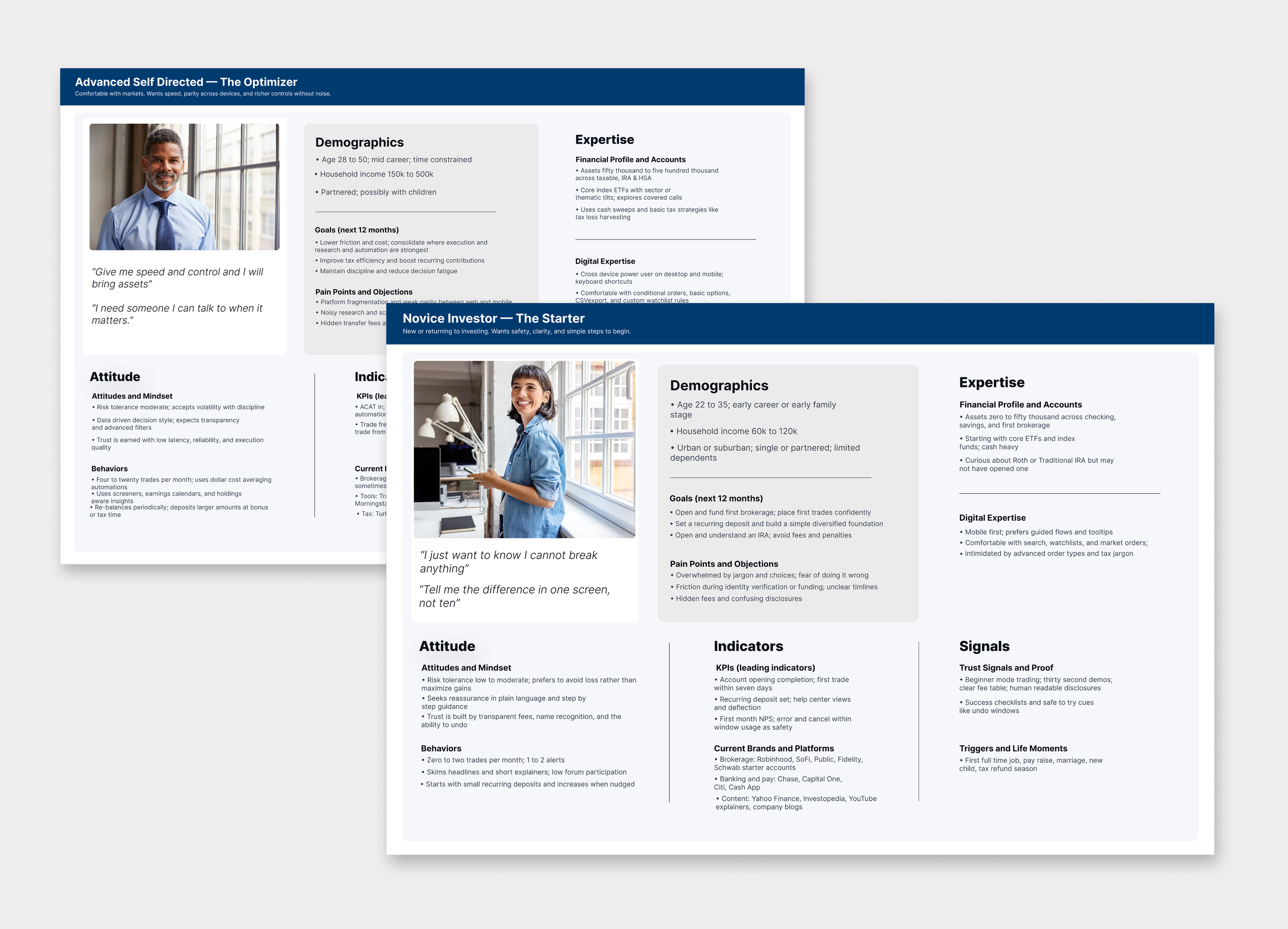

Understanding Our Audience

The customer journey connects moments—Awareness → Consideration → Account Opening → Onboarding → First Trade → Portfolio → Research → Advisory—so we can design the right support at the right time. Personas make those moments human and actionable. By modeling three core mindsets (Novice, Advanced, Seasoned), we tailor language, guardrails, and nudges to each investor’s needs—beginner-mode tickets for confidence, automation hubs for efficiency, and planning tools for strategy. We validate and iterate with telemetry, interviews, and support signals, turning the journey into a living roadmap tied to measurable outcomes.

Research & Discovery

From the start, we took a comprehensive research and discovery approach to inform both current and future concepts. Given Citi’s complexity and dual focus on customer- and internal-facing stakeholders, it was critical to capture feedback from both. We established three structures that enabled real-time input while providing a more structured way to measure progress.

We ran sprint-based testing with rapid turnaround from real customers. By targeting both new and existing Citi customers remotely, we gathered quick, directional feedback to inform ongoing work.

We conducted formal usability testing of prototypes using moderated questions and open feedback. This was applied early in discovery for concept testing and later in feature development to validate assumptions and capture new ideas for the backlog.

Because the investment suite relied on an internal support model, continuous feedback and collaboration with Citi’s support teams was essential. We identified a core group of champions and super users, conducting both formal and informal testing to gain buy-in and gather real-time insights.

Design Challenge

The initial goal was to establish Citi Self Invest, a self-directed, commission-free trading platform designed to make portfolio management simple, accessible, and scalable.

Key aspects of the challenge:

Initial launch: Brokerage account for existing Citi customers with seamless retail account funding

Expansion: Opened access to new Citi customers and Citi Wealth-only clients, creating a new market opportunity independent of existing infrastructure

Growth: Added Roth and Traditional IRAs to support long-term investing, strengthening Citi’s position in wealth management

Customer Experience Mapping

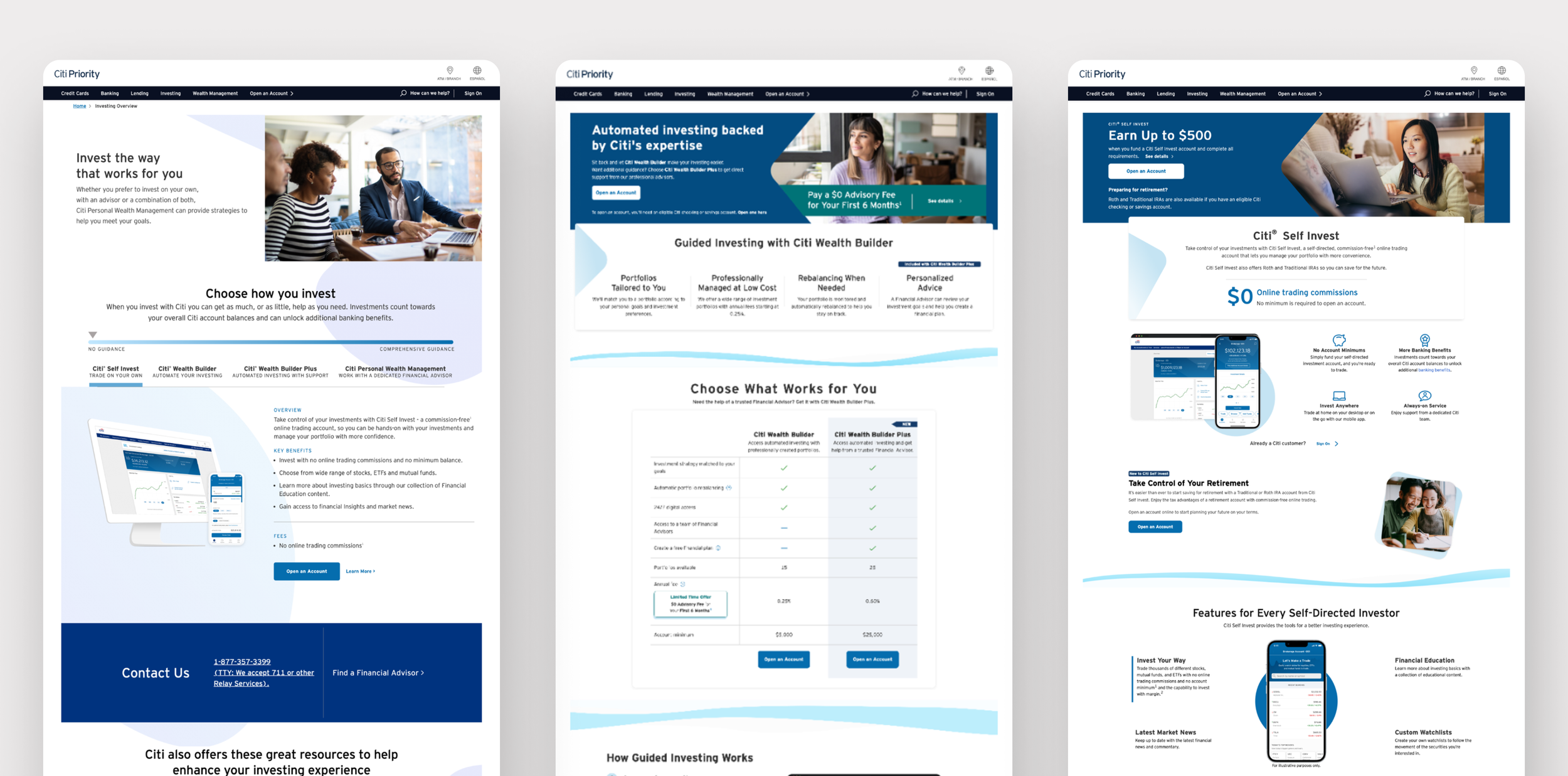

At the pre-login stage, we needed to balance Citi’s business goals, rolling product releases, and evolving customer needs—ensuring marketing and acquisition aligned with both features and customer objectives.

Key insights and approach:

Evolving messaging: Adjust marketing to match staggered product launches and new capabilities

Customer-centric acquisition: Focus not only on product comparisons, but on customer goals, life moments, and strategies for both short- and long-term investing

Behavioral insight: Most investors only switch providers when consolidating assets or working with an advisor

Opportunity: Position Citi Self Invest (CSI) as a simple, no-fee, low-risk entry point into Citi Wealth

Segmentation: Designed tailored pathways for Blue, Priority, Gold, and Private Client customers, with clear ways to ‘level up’ into expanded services

Ecosystem mapping: Identified all touchpoints to understand customer interaction and deliver the right experience at the right time

Summary: By mapping the ecosystem and customer journey, we built acquisition pathways that were flexible, relevant, and optimized for each customer segment—positioning Citi as a trusted partner for both new and existing investors.

Optimizing Marketing Pages

We optimized Citi’s marketing pages to clearly communicate the value proposition, provide an accessible product overview, and streamline acquisition pathways to convert prospects into customers. The challenge was conveying a clear product message that helped investors understand how each offering fit into their personal investment portfolio and goals.

Designing the Customer Experience

Designing Citi Self Invest required building a fully native, multi-platform experience from the ground up. Achieving platform parity was critical—allowing customers to seamlessly trade, research, track progress, and transfer funds anytime, anywhere. We began with market and consumer research to define our audiences, then created a roadmap that aligned features with both user needs and business goals.

Through rapid prototyping and an agile design process, the team was able to adapt quickly based on feedback while maintaining continuous alignment with internal governance and leadership.

Making a Trade

At the core of the experience was enabling customers to make trades seamlessly and with ease. Personalization features—such as Top Movers, Most Recent Trades, and Wishlists—were designed as key experience drivers, informed by customer insights and competitive research.

Personalization

Analyzing behavioral insights and feedback, feature personalization was part of our continuous update model improving and increasing customer interactions and behaviors.

Education and Research

Investment research and insights are a key differentiator for Citi, but delivering them in the right context was the challenge. Through persona development, customer research, and data analysis, we designed an experience that made research accessible without overwhelming users of varying experience levels. Our layered approach to findability, combined with adaptive behavior, surfaced content based on customers’ portfolio holdings and strategies—building both comfort and confidence in their decisions.

Learnings and Outcomes

Throughout the process from team conception to product delivery the resounding them was being able to adapt and lead through change. Citi is a large organization enabling many opportunities for customer reach and impact while having to understand the internal complexities of conflicting stakeholder objectives and constraints. Design acted as the connective tissue across business, product, and technology to illustrate and guide the strategy to produce such a large and complex solution.